Cryptocurrency markets are known for their volatility. This volatility attracts many investors. Some investors want to amplify their results. They use a tool called leverage. This article explains how to leverage crypto trading safely. It is written for beginners. We will avoid complex jargon. We will explain everything simply. By the end, you will understand the mechanics, risks, and rewards.

What is leverage trading?

Imagine you want to buy a house. You usually do not pay the full price upfront. You pay a down payment. The bank lends you the rest. Leverage in crypto is similar. It is borrowing money to trade.

You use your own funds as a deposit. This deposit is called “margin”. The exchange lends you more money. This increases your buying power. If you have $100 and use 10x leverage, you can trade with $1,000. This magnifies potential profits. However, it also magnifies potential losses.

Key Concept: Leverage allows you to control a large position with a small amount of capital. This is often called “capital efficiency”.

Start trading with the best platform

Bybit is a top-tier exchange for leverage trading. It offers high liquidity and professional tools. Use the exclusive referral codes below to unlock up to $30,000 in deposit rewards and fee discounts.

Don’t miss out on welcome bonuses. Terms apply.

The mechanics of leverage

To understand how to leverage crypto trading, you must understand the ratio. Leverage is expressed as a multiplier. Examples include 2x, 5x, 10x, or even 100x. The higher the number, the more money you borrow.

Let’s look at a simple comparison table to see the difference between Spot trading (normal trading) and Leverage trading.

| Feature | Spot Trading | Leverage Trading (10x) |

|---|---|---|

| Your Capital | $1,000 | $1,000 |

| Borrowed Funds | $0 | $9,000 |

| Total Position | $1,000 | $10,000 |

| Price Moves +10% | Profit $100 | Profit $1,000 |

| Price Moves -10% | Loss $100 | Loss $1,000 (Total Loss) |

As you can see, the profits are bigger. But the risk is also much bigger. In the 10x example, a 10% drop wiped out the entire investment. This is a critical point to remember.

Going long vs going short

Leverage gives you two directions to trade. You are not limited to buying and holding. You can profit when prices fall too.

Long position

Opening a “Long” position means you believe the price will go up. You buy the asset using leverage. You plan to sell it higher later. This is similar to standard investing, just amplified.

Short position

Opening a “Short” position means you believe the price will go down. This is unique to derivatives trading. You sell the asset first (borrowed from the exchange). You plan to buy it back later at a lower price. The difference is your profit.

Learning how to leverage crypto trading effectively involves knowing when to short. It allows you to make money during “bear markets” or crashes. While others are losing value, short sellers can generate returns.

Why choose Bybit for leverage?

Bybit is renowned for its “matching engine”. This ensures your trades execute instantly. No lag. No errors. This is crucial when trading with leverage.

- ✓ Low Fees: Keep more of your profits.

- ✓ High Liquidity: Enter and exit large positions easily.

- ✓ User Friendly: Great interface for beginners and pros.

Understanding liquidation

Liquidation is the biggest risk. It is the “Game Over” screen of trading. When you trade with leverage, you must maintain a minimum amount of equity. This is called “Maintenance Margin”.

If the price moves against you, your margin decreases. If it drops below a certain point, the exchange will close your position automatically. They do this to ensure they get their borrowed money back. You lose your initial deposit. To prevent this, traders must add more funds or close the trade early.

Tip: Always use a Stop-Loss. This is an automatic order to exit a trade before you get liquidated.

Step-by-step guide to your first trade

Here is a simple workflow on how to leverage crypto trading for the first time. Do not rush these steps.

- Register an account: Use a reputable exchange like Bybit. Ensure you complete Identity Verification (KYC) to lift limits.

- Deposit funds: Transfer USDT or USDC to your derivatives wallet. Stablecoins are preferred as collateral because their value does not fluctuate.

- Select a pair: Choose a liquid pair like BTC/USDT or ETH/USDT. Avoid obscure coins initially.

- Choose leverage: Select “Isolated Margin”. Set leverage to 2x or 3x. Do not go higher as a beginner.

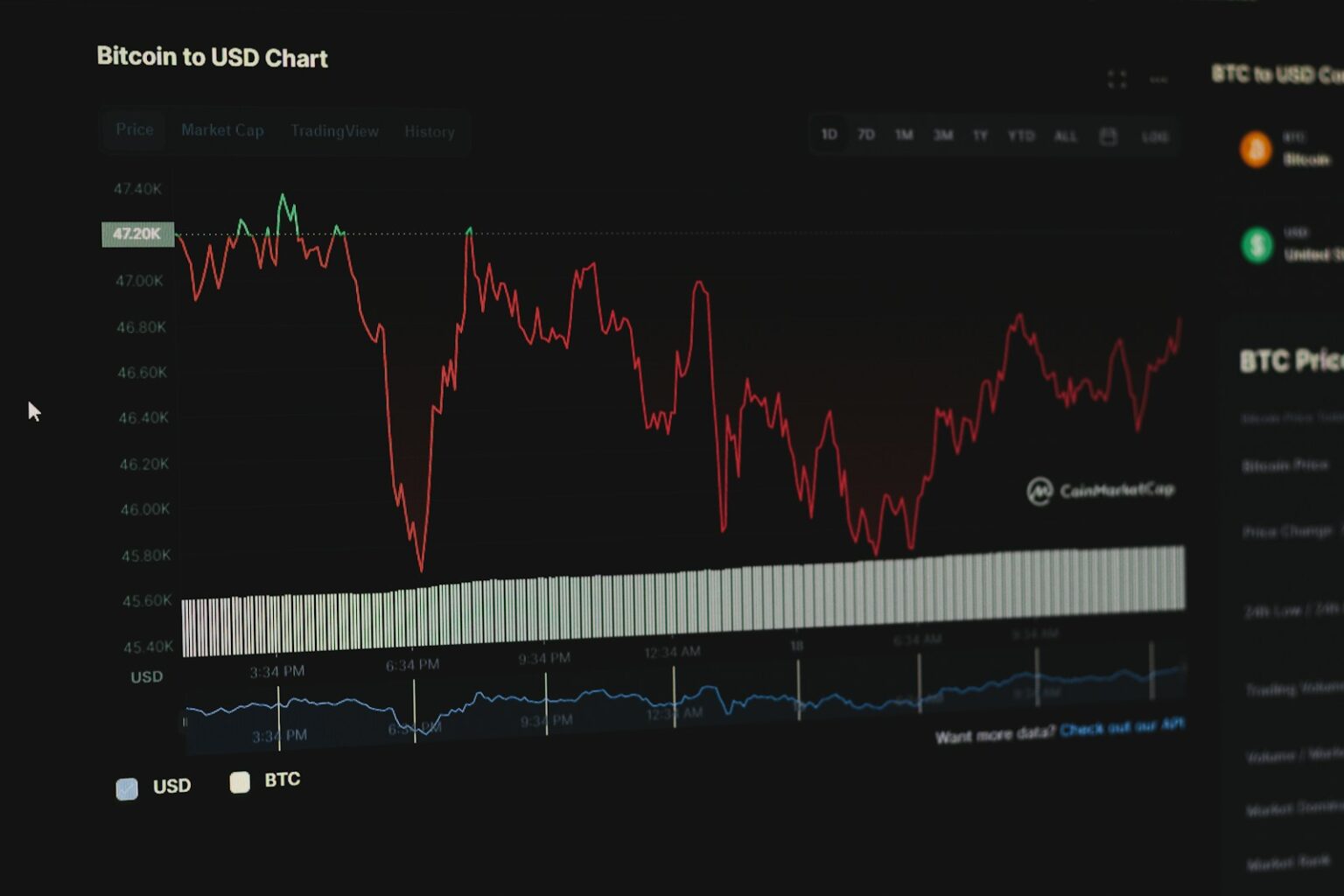

- Analyze the chart: Decide if the price will go up (Long) or down (Short).

- Set orders: Enter your entry price. Crucially, set a “Stop Loss” and a “Take Profit” level immediately.

- Execute: Click Buy/Long or Sell/Short.

Risk management strategies

Successful traders are not gamblers. They are risk managers. If you want to know how to leverage crypto trading successfully over the long term, you must manage risk.

The most important rule is position sizing. Never put all your money into one trade. A common rule is the “1% rule”. You should never risk losing more than 1% of your total account balance on a single trade. Even if you have a losing streak, you will still have money left to trade.

Another strategy is using “Isolated Margin” instead of “Cross Margin”. In Cross Margin, your entire account balance is at risk. In Isolated Margin, only the funds allocated to that specific trade are at risk. This protects the rest of your wallet.

Secure your financial future

The crypto market operates 24/7. Opportunities never sleep. Bybit provides the tools you need to capture these opportunities safely.

New User Bonuses: Up to $30,000 in rewards.

Common psychological pitfalls

Psychology is often harder than math. Leverage amplifies emotions. When you see profits soaring, you feel greed. When you see losses mounting, you feel fear.

Revenge Trading is a common mistake. This happens when you lose money. You get angry. You immediately open a new, larger trade to “win it back”. Usually, this leads to even bigger losses. You must stay calm. Take a break after a loss.

FOMO (Fear Of Missing Out) is another enemy. You see a coin pumping. Everyone is talking about it. You jump in with high leverage at the top. Then the price crashes. Always follow your plan, not the crowd.

Technical analysis basics

You cannot trade blindly. You need to read charts. Technical Analysis (TA) helps you predict price movements.

Support and Resistance: These are invisible lines on the chart. “Support” is a price level where the price tends to stop falling. “Resistance” is a ceiling where the price tends to stop rising. Buying at support and selling at resistance is a basic strategy.

RSI (Relative Strength Index): This indicator tells you if an asset is “overbought” or “oversold”. If the RSI is above 70, the price might drop soon. If it is below 30, the price might rise. Using these tools improves your understanding of how to leverage crypto trading accurately.

Choosing the right leverage level

Just because an exchange offers 100x leverage does not mean you should use it. High leverage is extremely dangerous. It leaves no room for error. A 1% move in the wrong direction can liquidate a 100x position.

Professional traders rarely use maximum leverage. They often stick to 3x, 5x, or maybe 10x. This gives the trade “room to breathe”. The price can fluctuate slightly without kicking you out of the trade. Lower leverage preserves your capital.

Ready to start your journey?

Join millions of traders on Bybit. Whether you are in Europe or anywhere else in the world, Bybit offers a secure and professional environment for your trades.

Code: BYBIT31

Code: BYBIT3K

Claim your exclusive benefits today.

Conclusion

Leverage is a powerful financial tool. It allows small traders to achieve big results. However, it demands respect. You must learn the mechanics. You must practice risk management. You must control your emotions.

We have discussed how to leverage crypto trading in detail. Remember to start small. Do not risk money you cannot afford to lose. Use the tools and stop-losses available on platforms like Bybit. With patience and discipline, leverage can be a valuable part of your trading strategy.

Frequently Asked Questions (FAQ)

What is the best leverage for beginners?

Beginners should start with very low leverage, typically between 2x and 5x. This reduces the risk of liquidation while you are learning the market dynamics.

Can I lose more than my deposit?

On most modern exchanges like Bybit, there is a negative balance protection. This means you generally cannot lose more than the funds you have in your trading account. However, you can lose your entire deposit.

What is the Bybit referral code for Global users?

For users outside the European Union, the best referral code is BYBIT31. This code unlocks deposit bonuses and fee discounts.

What is the Bybit referral code for EU users?

For users residing in the European Union, the specific referral code is BYBIT3K. This ensures compliance with local regulations while offering benefits.

What happens if I get liquidated?

Liquidation means the exchange automatically closes your position because your margin is insufficient to cover the loss. You lose the initial funds used for that trade.

Is leverage trading legal?

Yes, leverage trading is legal in many jurisdictions, but regulations vary by country. Always ensure you are using a platform that is authorized to operate in your region.

What is the difference between Isolated and Cross margin?

Isolated margin limits risk to a specific amount assigned to a trade. Cross margin uses your entire account balance to prevent liquidation. Isolated is safer for beginners.

Do I need to pay interest on leverage?

Yes, this is called the “Funding Rate”. It is a small fee paid periodically (usually every 8 hours) to keep the position open. It can be positive or negative.

Can I leverage trade on my phone?

Yes, platforms like Bybit have excellent mobile apps that allow you to monitor trades, set alerts, and execute orders from anywhere.

What is a Stop-Loss?

A Stop-Loss is an automatic order that sells your asset if the price drops to a certain level. It limits your losses and prevents total liquidation.