Welcome to the world of cryptocurrency trading. You may have heard about people buying Bitcoin or Ethereum. This is often called “spot trading.” You buy a coin, you own it, and you hope the price goes up so you can sell it later for a profit. It is simple and straightforward.

But there is another, more complex side to crypto trading. It is called margin trading.

Margin trading is like using a magnifying glass for your money. It allows you to control a much larger amount of cryptocurrency than you actually own. This can lead to much larger profits. But, it can also lead to much larger losses. It is a high-risk, high-reward strategy.

This Guide to Margin Trading Crypto is designed for absolute beginners. We will explain everything in simple terms. We will use easy-to-understand examples. There will be no complex jargon without a clear explanation. By the end of this guide, you will understand what margin trading is, how it works, and what risks are involved.

Chapter 1: What is Margin Trading?

In the simplest terms, margin trading is trading with borrowed money.

When you trade on margin, you are taking out a short-term loan from a third party. In crypto, this “third party” is almost always the exchange you are trading on, like Bybit. You provide a fraction of the total trade value, and the exchange lends you the rest.

Your own money that you put up is called the “margin” or “collateral”.

The borrowed money is what allows you to use “leverage”.

Simple Analogy: Imagine you want to buy a house worth $100,000. You only have $10,000. You go to a bank (the exchange) and get a loan for the other $90,000. Your $10,000 is the “margin.” You now control a $100,000 asset with only $10,000 of your own.

In crypto, this concept is applied to fast-moving trades. The multiplier effect from the loan is called leverage. If you have $100 and you use 10x (ten-times) leverage, you are borrowing $900 to control a $1,000 position.

To understand margin trading, you must know these key terms.

Key Margin Trading Terminology

Chapter 2: How Does Leverage Work? (The Magic and The Danger)

Leverage is the core concept of margin trading. Let’s use a very clear example to show how it magnifies both profits and losses.

Let’s say you have $100. You believe the price of Bitcoin (BTC) will go up.

Scenario 1: No Leverage (Spot Trading)

- You use your $100 to buy $100 worth of Bitcoin.

- The price of Bitcoin goes up by 10%.

- Your $100 worth of Bitcoin is now worth $110.

- You sell it. Your profit is $10.

- This is a 10% return on your $100.

Scenario 2: With 10x Leverage (Margin Trading)

- You use your $100 as margin.

- You select 10x leverage.

- The exchange lends you $900 (9 x $100).

- You now control a $1,000 position ($100 of your money + $900 borrowed).

- You open a “Long” position with this $1,000.

The Good Outcome: Price Goes Up 10%

- The price of Bitcoin goes up by 10%.

- Your $1,000 position increases in value by 10%. 10% of $1,000 is $100.

- Your position is now worth $1,100.

- You close the position. The $900 loan is automatically paid back to the exchange.

- You are left with $200 ($1,100 – $900).

- Your profit is $100.

Think about that. The market only moved 10%. But you made a 100% return on your initial $100. This is the “magic” of leverage.

The Bad Outcome: Price Goes Down 10%

Now, let’s look at the other side. This is the danger.

- You have the same $1,000 long position (your $100 + $900 borrowed).

- The price of Bitcoin goes down by 10%.

- Your $1,000 position loses 10% of its value. 10% of $1,000 is $100.

- Your position is now worth only $900.

- The exchange’s loan is $900. Your $100 margin is now gone.

- The exchange’s system sees this and liquidates your position.

- It closes the trade and takes the $900 to cover its loan.

- You are left with $0.

This is the most important rule of margin trading: Leverage magnifies your losses just as much as it magnifies your profits. A 10% price move against you can wipe out 100% of your investment.

This is the reality of How to Margin Trading Crypto. It is a double-edged sword. You must respect the risk.

Ready to Start Your Margin Trading Journey?

Bybit is a top-tier exchange, perfect for both beginners and pros. It offers a powerful trading engine, high liquidity, and a user-friendly interface.

Sign up with our referral codes to get the best start!

Global Code: BYBIT31 |

EU Code: BYBIT3K

(Enjoy benefits like a welcome bonus up to $30,000 and fee discounts!)

Chapter 3: Long vs. Short Positions (The Two-Way Street)

One of the biggest advantages of margin trading is the ability to profit from a falling market. This is not possible with simple spot trading.

Going Long (A Bullish Bet)

This is the one we already discussed. It is simple.

You “go long” when you believe the price of an asset will go up. You are buying (with leverage) now, hoping to sell at a higher price later.

If the price goes up, you make a profit. If the price goes down, you make a loss.

Going Short (A Bearish Bet)

This is a bit more complex, but it is a powerful concept.

You “go short” when you believe the price of an asset will go down. You are selling (with leverage) now, hoping to buy it back at a lower price later.

How can you sell something you do not own? Remember, you are trading with borrowed funds.

Shorting Analogy:

- You borrow 1 Bitcoin (BTC) from the exchange. The price is currently $10,000.

- You immediately sell that 1 BTC on the market. You now have $10,000 in cash.

- You wait. As you predicted, the price of BTC crashes. It is now worth $8,000.

- You use your cash to buy 1 BTC for $8,000.

- You return the 1 BTC to the exchange (to pay back your loan).

- You are left with $2,000 in profit ($10,000 – $8,000).

Modern exchanges make this very easy. You just click the “Short” or “Sell” button. The exchange handles the borrowing and selling in the background.

If the price goes down, you make a profit. If the price goes up, you make a loss. (Because you will have to buy back the 1 BTC at a higher price to return it).

This ability to trade in both directions is a key feature of margin trading and derivatives. This complete Guide to Margin Trading Crypto would be incomplete without this crucial point.

Chapter 4: The Most Important Concept: Liquidation

We have mentioned this, but it deserves its own chapter. Liquidation is the complete loss of your margin.

It is not a punishment. It is the exchange’s risk management system. Remember, the exchange lent you most of the money for your trade. It does not want to lose its money.

Liquidation happens when the market moves against you so much that your losses are almost equal to the margin you put up.

Example:

- You have a $1,000 long position with 10x leverage.

- Your margin is $100. The loan is $900.

- The “Liquidation Price” will be roughly 10% below your entry price.

- If the price drops to that level, the exchange forcefully closes your position. It takes the remaining $900 to cover its loan. Your $100 is gone.

The higher your leverage, the closer your liquidation price will be to your entry price.

- With 10x leverage, a 10% move against you causes liquidation.

- With 20x leverage, a 5% move against you causes liquidation.

- With 50x leverage, a 2% move against you causes liquidation.

- With 100x leverage, a 1% move against you causes liquidation.

This is why using 100x leverage is like gambling. The price can move 1% in a single second.

Isolated Margin vs. Cross Margin

Exchanges give you two ways to manage your margin. This is a critical choice.

1. Isolated Margin:

- You assign a specific amount of your money to a single trade.

- Example: You have $1,000 in your account. You decide to open a trade using $100 as Isolated Margin.

- If this trade gets liquidated, you only lose that $100. The other $900 in your account is completely safe.

2. Cross Margin:

- This mode uses your entire account balance as collateral for all your open positions.

- Example: You have $1,000. You open a trade. The system will automatically pull from your $1,000 balance to prevent the trade from being liquidated.

- The good: Your liquidation price is much further away, because your entire account is backing the trade.

- The bad: If the price moves against you far enough, you can be liquidated and lose your entire $1,000 account.

Beginner’s Tip: Always start with Isolated Margin. This is the safest option. It limits your risk to only the money you put into that specific trade. You cannot lose your whole account from one bad trade.

Learn How to Margin Trading Crypto Safely

Bybit offers robust risk management tools. Practice with Isolated Margin and set Stop-Loss orders to protect your capital. It’s the smart way to trade.

Use our exclusive codes for a powerful start!

Global (Non-EU): BYBIT31 |

EU Users: BYBIT3K

(Claim your welcome rewards and trading bonuses!)

Chapter 5: The Costs of Margin Trading

Borrowing money is not free. There are costs involved that can eat into your profits.

1. Trading Fees (Maker / Taker)

Every time you open or close a position, you pay a small trading fee. This is standard on all exchanges.

- Taker Fee: You pay this if you place a “Market Order” (an order that fills immediately). You are “taking” liquidity from the market.

- Maker Fee: You pay this (or sometimes get paid a rebate) if you place a “Limit Order” (an order that waits at a specific price). You are “making” liquidity for the market.

Keep in mind, these fees are charged on your total position size, not just your margin. A 0.1% fee on a $1,000 position is $1, even though you only used $100 of your own money.

2. Funding Rates (Interest)

This is the most important cost. This is the interest you pay for the loan.

In crypto, this is usually called the “Funding Rate”. It is a fee that is paid between long and short positions to keep the contract price in line with the spot price.

- Funding rates are typically paid every 8 hours.

- If the rate is positive, longs pay shorts. This usually happens in a bull market when many people are betting on the price to go up.

- If the rate is negative, shorts pay longs. This is less common but happens in strong bear markets.

If you hold a leveraged position for many days or weeks, these funding payments can add up and significantly reduce your profit. This is why margin trading is often (but not always) used for shorter-term trades. This is a key part of any Guide to Margin Trading Crypto.

Chapter 6: Risk Management: How Not to Lose Everything

This is the most important chapter in this entire guide. Reading this could save you thousands of dollars.

Margin trading is dangerous. Most beginners fail because they have no risk management. They get greedy, use too much leverage, and get liquidated.

Do not be one of them. Follow these rules.

Rule 1: Start Small. Very Small.

Do not trade with money you cannot afford to lose. Never trade your rent money, your food money, or your savings.

When you start, trade with $50 or $100. Consider this money the cost of your education. Your goal is not to get rich on day one. Your goal is to learn and survive.

Rule 2: Use Low Leverage.

Just because the exchange offers you 100x leverage, it does not mean you should use it. 100x leverage is for gamblers, not traders.

As a beginner, do not use more than 2x, 3x, or 5x leverage. This gives you room to breathe. The market can move against you 10-20% and you will not be liquidated. It allows you to learn the process without being instantly punished for a small mistake.

Rule 3: Use a Stop-Loss (SL) on Every Single Trade.

This is not optional. A Stop-Loss (SL) is an automatic order you place with the exchange. It tells the exchange: “If the price goes against me and hits this specific level, close my trade immediately.”

It is your safety eject button. It ensures you take a small, controlled loss instead of a catastrophic, liquidating loss.

A trader who does not use a stop-loss is planning to fail. A stop-loss removes emotion. You decide your maximum pain point before you enter the trade, when you are calm and logical.

Rule 4: Use a Take-Profit (TP).

This is the other side of a stop-loss. A Take-Profit (TP) order automatically closes your trade when it hits a certain profit target.

This prevents greed. Many new traders watch a profitable trade turn into a losing one because they “wanted more.” Secure your profits.

Rule 5: Understand the Risk-to-Reward Ratio (R:R).

This is a simple. Before you enter a trade, compare your potential loss (your Stop-Loss) to your potential profit (your Take-Profit).

A good trade should have a R:R of at least 1:2. This means you are risking $1 to make $2. Or risking $50 to make $100.

Why is this so important? Because if you have a 1:2 R:R, you only need to be right 34% of the time to be profitable. You can be wrong most of the time and still make money. This is how professionals trade.

This is the true secret of How to Margin Trading Crypto successfully. It is not about winning every trade. It is about making your wins bigger than your losses.

The Best Platform for Margin Trading

Why do so many traders choose Bybit? Low fees, a non-lagging trade engine, and deep liquidity mean your orders get filled fast and at the price you want. It’s built for performance.

Don’t forget your exclusive welcome pack!

Global Code: BYBIT31 |

EU Code: BYBIT3K

(Get access to promotions and bonuses up to $30,000!)

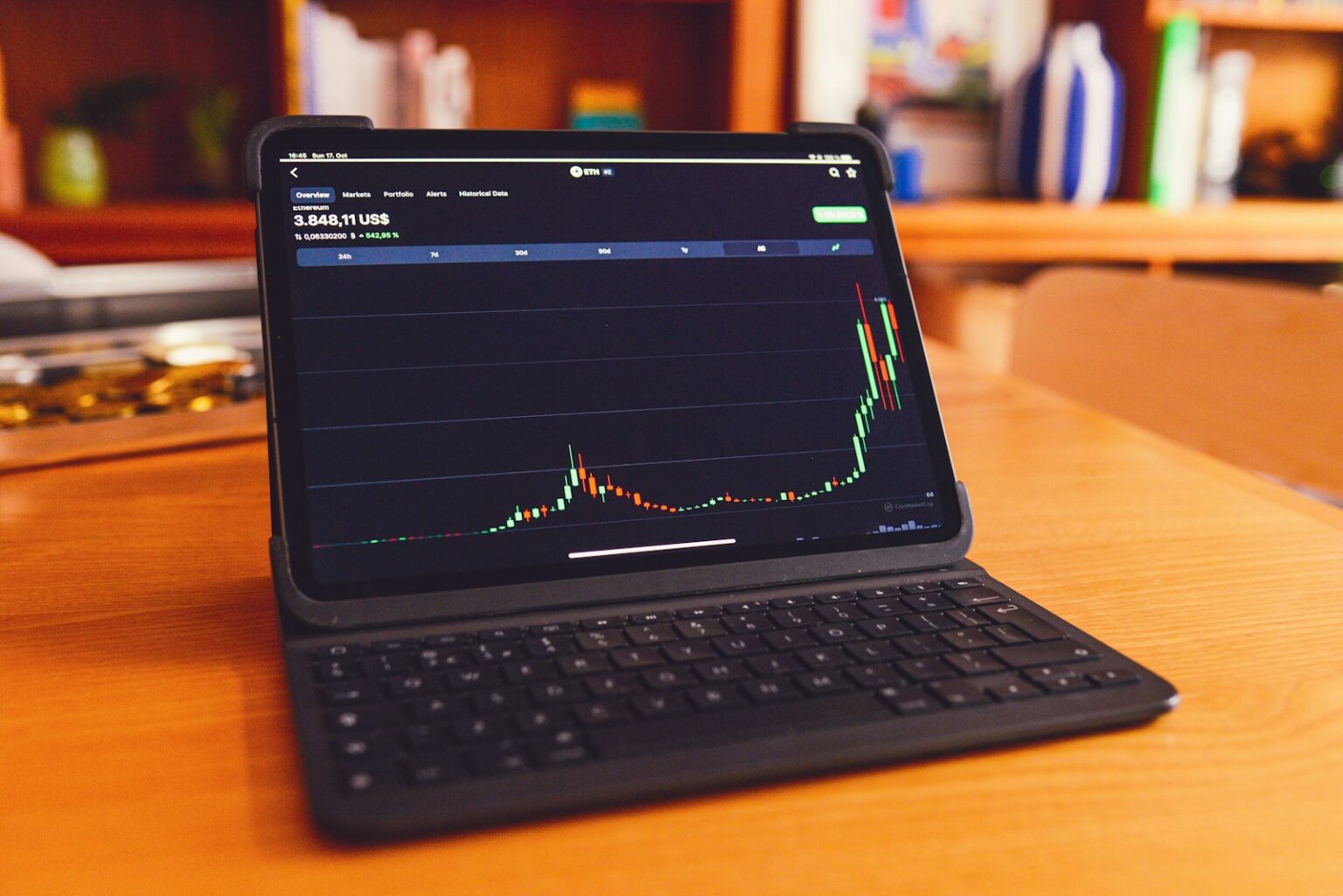

Chapter 7: Step-by-Step: How to Margin Trading Crypto on Bybit

Let’s put it all together. Here is a simple, step-by-step walkthrough of placing your first margin trade. We will use Bybit as the example, as it is an excellent platform for this.

- Create Your Account: Go to Bybit and sign up. (This is the perfect time to use the referral code BYBIT31 for global users or BYBIT3K for EU users to get your welcome bonus).

- Deposit Funds: You need to fund your account. You can deposit crypto (like BTC, ETH, USDT) or use a credit card to buy crypto directly on the platform.

- Transfer to Derivatives Wallet: Exchanges have different “wallets” for different purposes. Your deposited money will likely be in your “Spot” or “Funding” wallet. You must transfer the amount you want to trade with (e.g., $100) to your “Derivatives” or “Unified Trading” wallet. This is instant and free.

- Choose Your Trading Pair: Go to the “Derivatives” section and select the pair you want to trade, for example, BTC/USDT.

- Find the Trade “Box”: On the right side of the screen, you will see the order panel. This is your command center.

- Select Margin Mode: At the top of the order panel, choose your margin mode. Select “Isolated” as we discussed.

- Select Leverage: You will see a slider or a place to type in your leverage. Adjust it to 5x or less.

- Place Your Order:

- Limit Order: If you want to enter at a specific price, use a “Limit” order.

- Market Order: If you want to enter immediately at the current price, use a “Market” order. (This is simpler for your very first trade).

- Set SL and TP: DO NOT FORGET THIS STEP. Look for the “Set TP/SL” checkbox.

- Take Profit: Enter the price you want to sell at for a profit.

- Stop Loss: Enter the price you want to sell at for a small loss.

- Open Your Position: Enter the amount you want to trade (e.g., $100). Click the big green button “Open Long” (if you think price will go up) or the big red button “Open Short” (if you think price will go down).

- Monitor Your Trade: At the bottom of the screen, your new trade will appear in the “Positions” tab. You can see your profit/loss, your liquidation price, and you can close the trade manually at any time.

That’s it! You have just opened your first leveraged trade. This practical knowledge is the final piece of this Guide to Margin Trading Crypto.

Conclusion: A Powerful Tool, Not a Toy

Margin trading is a powerful tool. It gives you the ability to amplify your gains and to profit from any market direction, up or down.

But it is not a toy. It is a very, very sharp double-edged sword. Without respect, education, and strict risk management, you will get badly hurt. The market does not care about your hopes or feelings.

The key takeaways from this guide are:

- Start with Isolated Margin.

- Use low leverage (5x or less).

- Use a Stop-Loss on every single trade.

- Only trade with money you can afford to lose.

Education is your best defense. Continue to learn, practice with small amounts, and stay disciplined. This is the only way to survive and, eventually, thrive in the world of crypto margin trading.

Your Journey Starts Now

You have the knowledge. The next step is practice. Open an account on Bybit, the world’s most reliable and user-friendly crypto derivatives platform.

Use our referral codes for the best welcome bonuses available:

Global Code: BYBIT31 |

EU Code: BYBIT3K

(These codes give you access to deposit bonuses and fee-reduction coupons!)

Frequently Asked Questions (FAQ)

1. Is margin trading the same as spot trading?

No. In spot trading, you buy an asset (like 1 BTC) with your own money and you own it. You can hold it for 10 years or send it to a private wallet. In margin trading, you are borrowing funds to trade a contract. You do not own the underlying asset. It is a high-risk, short-term trading tool.

2. Can I lose more money than I deposit?

On modern crypto exchanges like Bybit, no. You cannot lose more than the money you have in your margin account. The liquidation system is designed to close your trade before it goes into a negative balance. You can lose all the money you put into a trade (your margin), but you will not end up owing the exchange money.

3. What is the best leverage for a beginner?

The lowest possible. We strongly recommend starting with 2x, 3x, or a maximum of 5x leverage. This gives you a wide margin of error and prevents you from being liquidated by small, normal price movements. Using 50x or 100x as a beginner is the fastest way to lose all your money.

4. What is the difference between Isolated and Cross Margin?

Isolated Margin “isolates” or limits the risk to only the money you put into one specific trade. Cross Margin uses your entire account balance as collateral. Beginners should always use Isolated Margin to avoid losing their entire account on a single bad trade.

5. Why should I use Bybit for margin trading?

Bybit is highly recommended for margin (derivatives) trading because of its speed, reliability, and liquidity. Its trading engine rarely overloads during high volatility, which is when you need it most. It also has a very user-friendly interface.

6. What are the Bybit referral codes and what do they do?

Using a referral code gives you a sign-up bonus. For Bybit, you should use:

- BYBIT31 if you are a Global user (outside the EU).

- BYBIT3K if you are a user in the European Union (EU).

These codes give you access to welcome rewards, deposit bonuses (which can be up to $30,000), and trading fee coupons.

7. What is a “funding rate”?

It is the “interest payment” for your loan. It is typically paid every 8 hours. If the rate is positive, traders in long positions pay traders in short positions. If it is negative, shorts pay longs. If you are holding a trade for a long time, this cost can become significant.

8. What is a Stop-Loss and why is it important?

A Stop-Loss (SL) is an automatic order to close your trade at a predetermined price. It is the single most important risk management tool. It ensures you take a small, defined loss, rather than a massive, liquidating loss. You should use a Stop-Loss on every trade.

9. Can I practice margin trading without real money?

Yes! Many exchanges, including Bybit, offer a “Testnet” or “Demo Account.” This allows you to trade with “paper money” (fake money) in a real market environment. It is the perfect way to practice your strategy, learn the interface, and understand How to Margin Trading Crypto without risking any real capital.

10. I am in the EU. Which Bybit referral code should I use?

If you are a resident of the European Union, you should use the specific EU code: BYBIT3K. If you are outside the EU, you should use the global code: BYBIT31. Using the correct code ensures you get the promotions that are valid for your region.